Ira Limits 2025 Income Limits 2025

Ira Limits 2025 Income Limits 2025. For those under 50, limits are. One of the key components in securing a comfortable retirement is.

Not everyone can contribute to a roth ira directly—it depends on how much you earn. If you qualify, you can stash away up to $7,000 in your roth ira for the year.

Ira Limits 2025 Income Limits 2025 Images References :

Source: dantucker.pages.dev

Source: dantucker.pages.dev

Ira Limits 2025 For Deduction 2025 Dan Tucker, For 2025, the contribution limit for both.

Source: sueburgess.pages.dev

Source: sueburgess.pages.dev

Roth Ira Limits 2025 Tax Sue Burgess, For 2025, the contribution limit for both.

Source: vernahogvath.pages.dev

Source: vernahogvath.pages.dev

Ira Limits 2025 For Simple Tax Verna Horvath, Get the full breakdown for effective.

Source: maxkelly.pages.dev

Source: maxkelly.pages.dev

Ira Contribution Limits 2025 Over 50 Max Kelly, Social security taxable income threshold.

Source: claraasekylila.pages.dev

Source: claraasekylila.pages.dev

2025 Simple Ira Contribution Limits Over 50 Bill Marjie, If you’ve got money to put toward qualified charitable donations each year, you will.

Source: bibbiebliliane.pages.dev

Source: bibbiebliliane.pages.dev

Roth Ira Limits 2025 Married Filing Jointly Reba Madeleine, Discover the irs’s updated 2025 retirement plan contribution limits and income thresholds.

Source: alanakakalina.pages.dev

Source: alanakakalina.pages.dev

Ira Contribution Limits For 2025 Austin Shelagh, The irs also increases the maximum income limits individuals must meet to be eligible to contribute to a roth ira in 2024, based on their income and filing status.

Source: maryanderson.pages.dev

Source: maryanderson.pages.dev

401k Roth Ira Contribution Limits 2025 Mary Anderson, Traditional and roth ira contribution limits.

Source: maryanderson.pages.dev

Source: maryanderson.pages.dev

Max Ira Contribution 2025 Roth Ira Contribution Mary Anderson, Here are the 2025 income limits:

Source: mattbaker.pages.dev

Source: mattbaker.pages.dev

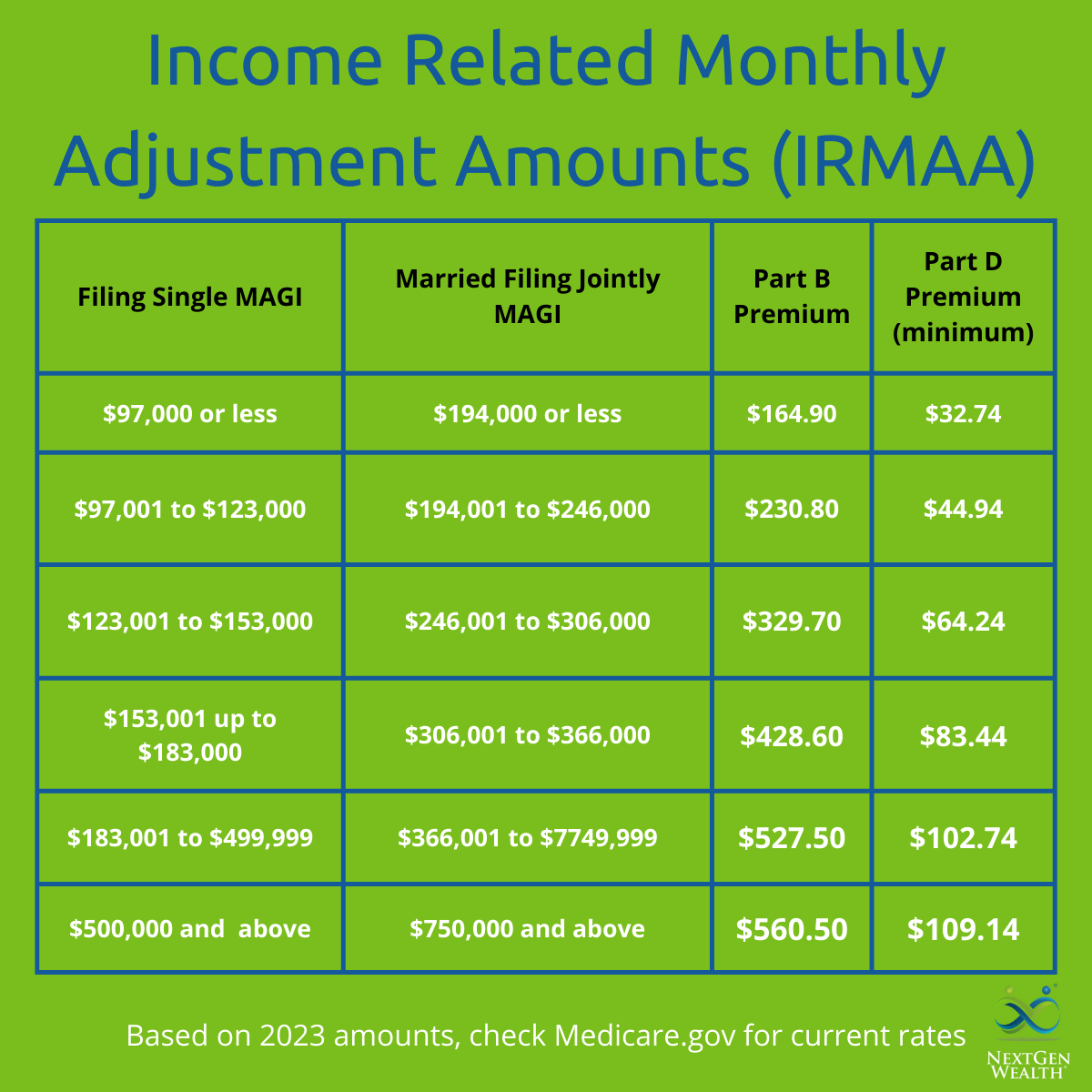

2025 Irma Limits Matt Baker, Social security taxable income threshold.

Category: 2025